Good bookkeeping tells the story of how your business is (or isn’t) making money. The first step to good bookkeeping is a clean chart of accounts.

What is a chart of accounts?

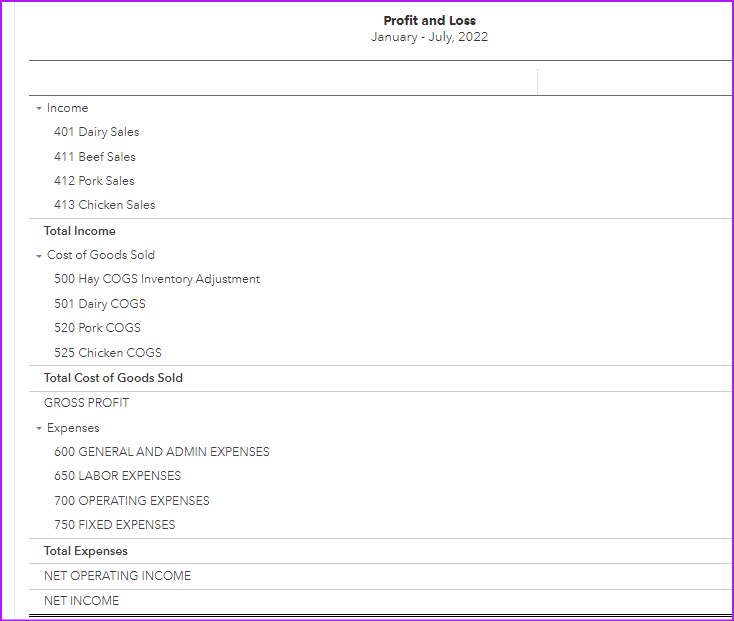

The chart of accounts is the structure for categorizing how transactions show up on your financial statements. The chart of accounts includes both income and expenses to track the money coming in and going out of the business as well as assets, liabilities, and equity that provide a snapshot of your business at a point in time.

A chart of accounts should not be too complicated. Your business should be separated into enough categories to see the trends in your transactions, but not so many categories that you won’t use them. You don’t need a separate category for every type of insurance on the farm or each variety of pepper that you grow.

Why have a clean chart of accounts?

A clean chart of accounts sets you up to make informed decisions about your business and your finances. You are able to:

- Understand how your business makes money.

- Spend less time plugging in numbers and more time analyzing the business.

- See how numbers change over time. You can tell if you’re moving in the right direction or if something is becoming a problem.

- Make informed business decisions and understand how they will impact your income and expenses.

It may seem like a small thing, but the way that you categorize your transactions can have a big impact on your financial success. It’s never too late to clean up the books and start using a chart of accounts that works for you.

Free Resource

Kitchen Table Consultants sets up the chart of accounts in the same way for each of our clients. This standard categorization allows us to easily track trends, analyze the business, and make decisions.

If your chart of accounts is messy, try cleaning it up using KTC’s Basic Chart of Accounts.