The question of what happens to a business after an owner steps aside, retires, or sells is critically important. Crafting a strong succession plan means that your business can continue to flourish and serve your customers while you step aside with both peace of mind and financial stability.

Succession planning requires trust and open communication. In this blog post, we will review a case study of a succession plan, then explore the five things you need for successful succession planning.

Transferring Ownership within the Family: A Farm Business Succession Planning Case Study

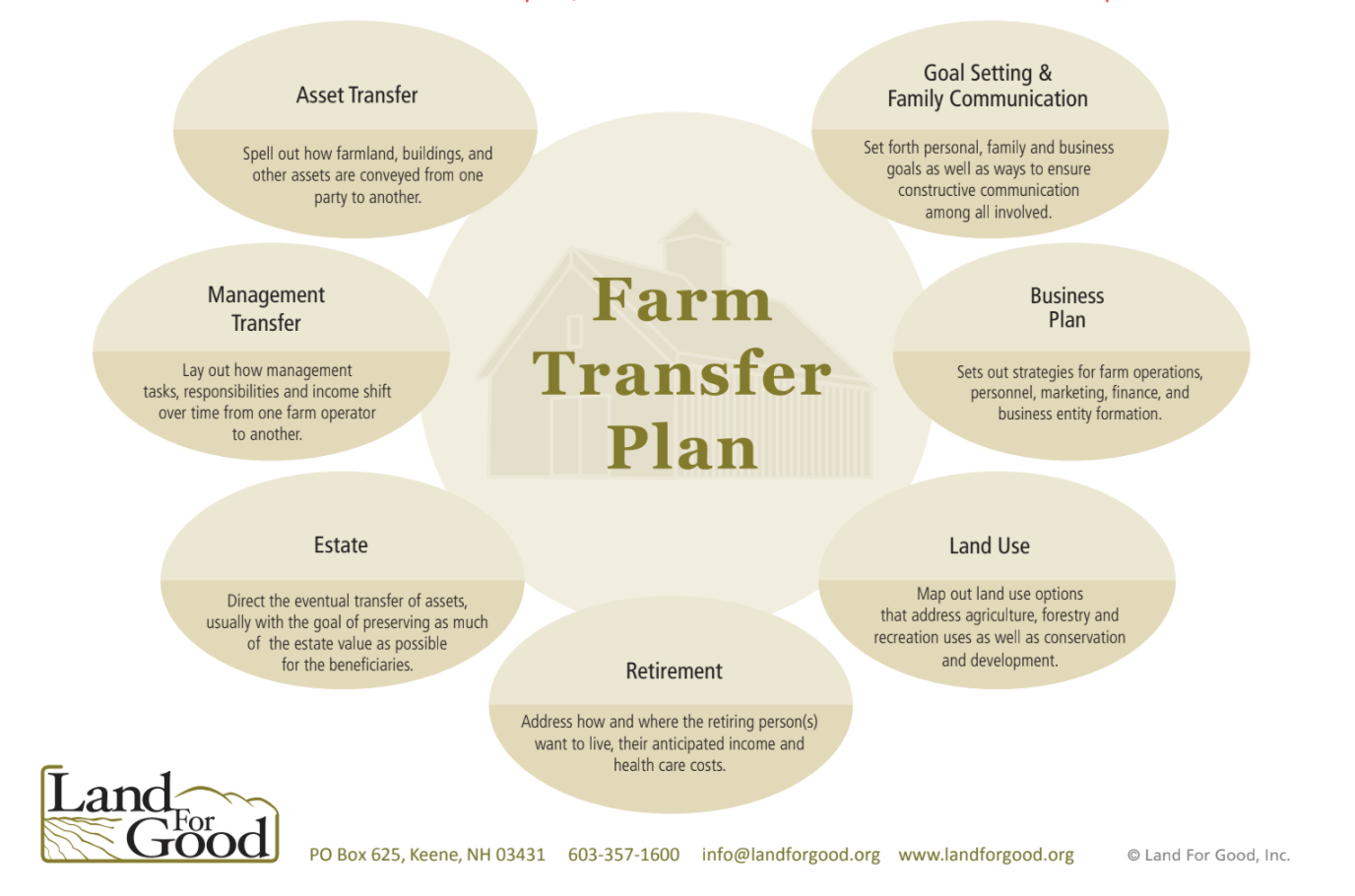

At Kitchen Table Consultants, we use a farm transfer plan framework borrowed from Land for Good to support our clients through the succession planning process.

The framework guides us and ensures that we hit all the necessary elements to make the transition as smooth and successful as possible.

Recently our team made a succession plan with one of our long term clients. The family was looking to transfer ownership of the farm from father to son. When we started the planning process, they each owned a 50% share in the successful, diversified farming business.

The first step in our succession planning process was goal setting and family communication. We sat down with the clients to map out their goals as clearly as possible. We reviewed the assets that would be transferred, discussed why the transfer was occurring, and confirmed that all parties really wanted to undertake the transfer.

The son was looking to further establish the business so that he could pass it on to his own children. The parents wanted to transfer the farm so that it would continue to succeed, but were concerned about finding a way to stay involved in the operation post-transition. For them, the farm was a meaningful part of their lives personally and from a business standpoint.

After clarifying goals, we established a timeline for the transition. The planning process would take roughly six months followed immediately by the transfer itself. This gave everyone time to work through all of the details and negotiations thoroughly and satisfactorily.

After establishing goals, we moved on to creating the business plan for the future of the farm.The new business plan took into account the succession terms and made sure that the business would be able to continue operating profitably. It proved, through a 5 year pro-forma budget, that the transition would be viable and allow the business to succeed, even with the added transition expenses.

We didn’t address land use during this particular succession plan. Land use isn’t our wheelhouse and we recommend seeking a specialist for that portion of the planning if needed. Your local university ag extension office should be able to support you with finding a land use specialist.

We did spend a long time figuring out retirement for the seller. During the goal setting process it had become clear that one of the guiding outcomes of this process was to provide enough cash to allow the sellers to retire and maintain their quality of life.

We established how much money they needed monthly in retirement, then set up a seller financing plan with a monthly payout over a set period of time that would essentially serve a monthly retirement income.

Estate planning could also have been part of the conversation, but as it’s not one of our specialties we recommended talking it through with an attorney.

Finally, we worked through the management and asset transfer logistics.

Going into the conversation, the father and son each owned 50% of the business and the son was looking to get 100% ownership. However, we established during goal setting that the father still hoped to have some involvement in the day-to-day management of the business after selling. In order to facilitate that, we adjusted the terms of the sale such that the son got 90% ownership and the father retained 10%.

Strategizing the management transfer was important to keeping the business operating smoothly. Fortunately, in this case the seller and buyer had both been running the business together for years so the transfer was simple.

The asset transfer entailed assessing the value of the business, clearly laying out terms of the transaction, and setting the timeline for payment. It was the culmination of all of the planning that had come before.

In this instance, the entire succession planning process took roughly six months. Throughout it we worked closely with the business’ CPA and attorney. The CPA provided a check for our calculations and was particularly valuable when it came to figuring out tax liabilities. The attorney was a second checkpoint and handled the creation of all legal documents.

The collaboration with these outside parties and the willing participation of both the buyer and sellers allowed our succession planning process to occur smoothly and productively. It wasn’t without its hard conversations and logistical challenges – but, ultimately everyone achieved their goals. The sellers will get to enjoy a well-funded retirement and a bit of involvement in the management of the farm. The buyer will be able to steward the business until he can pass it on to his own children.

5 Things You Need for a Successful Succession Plan

Succession planning can be challenging. In order to set yourself up for success, make sure you have these five things in place before you start.

- A business that’s worth transitioning

In order to transition a business, it needs to be able to keep operating into the future and withstand the financial pressure of the transition. Therefore, make sure your business is financially healthy.

- Clear and open communication between all parties

Succession planning involves lots of open communication and compromise. It’s important to come into the process ready to create collective goals and work towards a solution that serves all parties.

- An understanding of the business and personal goals of all parties

Though the ultimate end of the process is collective benefit, it’s easier to make that happen when each party understands their personal goals. Do some thinking ahead of time about what you hope to achieve through the succession process.

- Accurate financials and a baseline of all assets being valued

In order to transfer the business, you need a fair way to value it and its assets. Clean, accurate financials and transparent records are a key element of this process.

- A support team

You don’t need to, and you should not, make a succession plan alone! The support of an attorney and CPA are absolutely essential to make sure that your plan is legally and financially sound. We also recommend working with a business consultant and facilitator like Kitchen Table Consultants to do the facilitation, help figure out your goals, and create plans for retirement and financing. A business consultant is familiar with your business and able to lay the groundwork of the succession plan for much less money than an attorney doing the entire thing.

Succession planning is complex, but with a bit of forethought and a strong team, it can easily achieve the goals of all parties involved.